Do you know you can use USDT to earn massive returns? While USDT is a well-known stablecoin, many investors miss out on its profit potential. And all it takes to earn more profit with Tether Holdings is choosing the right trading strategies. But with hundreds of options, choosing one might be a hassle. Fortunately, we are here to help. In this comprehensive guide, we save you the trouble and provide the strategies that promise the most returns. Keep reading for tips on how to guarantee a profitable USDT trading experience.

Understanding USDT

Before we explore the different trading strategies, it is essential to understand this stablecoin. USDT is a ticker symbol of the cryptocurrency Tether, which is tied to the U.S. dollar. The asset fluctuates with the value of the dollar and is backed by Tether’s dollar reserves. The stability of USDT means it is an excellent asset to HODL.

USDT has many trading pairs, so you can enter the market seamlessly. An example is USDT/NGN, which means you don’t need to go through several conversions. Now that we understand USDT, let’s explore the different profitable trading strategies.

Exploring the Different Trading Strategies

Investors need trading strategies before they enter the market to maximize profit. This section explores the strategies to maximize your portfolio:

1. Dollar Cost Averaging (DCA)

Dollar Cost Averaging is a popular strategy among beginners and experts alike. This strategy involves splitting your investment into smaller amounts. These small amounts are then used to invest in USDT consistently over a period of time.

Assuming you have ₦1,000,000 to invest, opting for DCA means you split the amount. Hence, you might divide the amount into ₦100,000 in ten places to invest in USDT every Tuesday at 11:00 am. While we chose every Tuesday, the time you want depends on your risk appetite. It can be weekly, bi-weekly, or even monthly. This method mitigates the blow of a volatile market. Plus, you get to reap the benefits of buying at a lower price and earn more USDT that way.

2. Event-Driven Trading

If the dollar increases in value, USDT follows, and you get the dividends. Several events strengthen the U.S. economy and, inevitably, the dollar. You can use this knowledge to your advantage. You can trade crypto assets for USDT when you suspect a rise and vice versa. Moreover, using this tactic can combat inflation.

3. Arbitrage

Arbitrage trading is a strategy that has attracted a lot of attention. This strategy involves buying a crypto asset at a crypto exchange and selling it at another. The difference between the amount you buy an asset at an exchange and the price you sell at another exchange is your profit. This difference is usually because of liquidity, trading volume, and traders. To start, you need to open accounts at two different exchanges with wide price margins.

4. Scalping

Scalping is a widely accepted short-term trading strategy. This technique involves quickly entering and exiting the market, taking advantage of slight price movements. Hence, most trades are a few minutes’ top. Scalping is especially profitable for active day traders who monitor minute price changes. The moment the minute trade becomes profitable, they exit the market.

Scalping does not require waiting. The strategy’s success is embedded in the swift entry and exit of the market. This strategy is extremely profitable when the market is volatile. However, it is crucial to note that it is risky. So, when moving in and out of a trade, you have to be cautious.

5. Avoid Trading On Hype

When trading USDT, it is important to avoid trading on hype. This mistake is common among beginners. Most times, this happens when you get updates from social media. Investment decisions should be independent of social media hype. Cryptocurrency is a large industry, which means misinformation spreads fast. So, watch out before you leave or enter a market based on what someone tweeted or posted online.

How Do You Convert USDT to Cash Using Breet?

A seamless USDT to cash transaction is usually the next stop after a successful trade. So, here is how you can convert your USDT to Cash with Breet in seven easy steps:

1. Download and Register an Account:

You can download the Breet app whether you use an Android or iOS device on the app store. If you prefer a web version, there’s a convenient web app.

N.B.: You get a permanent wallet address automatically generated after sign-up.

2. Verify Your Account:

Once you register, you need to submit a government-issued document for verification. Don’t worry; this step only takes a couple minutes.

3. Time to sell your USDT:

Go to “Crypto-to-cash” and tap on USDT. Copy the auto-generated wallet address or scan the QR code that pops up. Paste it on the sending wallet.

4. Sit back and relax:

Breet will detect the incoming transaction and begin to process it instantly. You’ll be given an estimated transaction complete time.

5. USDT-to-Naira/Cedis complete:

In a couple moments, you’ll receive your now-converted USDT in Naira/Cedis, which you can now send to your local bank account.

Frequently Asked Questions (FAQs) About Profitable USDT Trading Strategies

How Much is USDT worth in Naira?

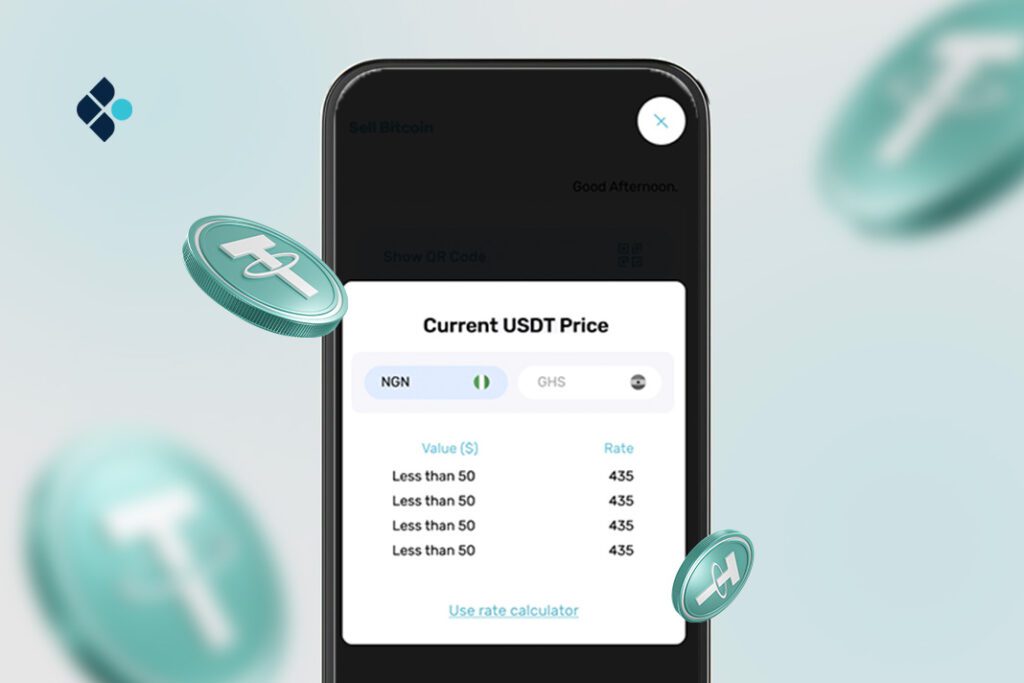

USDT is worth one dollar. Hence, the current exchange rate of one dollar to naira is the same as USDT to naira. Check our Breet rate calculator for the up-to-date exchange rate.

Can I Stake USDT?

Yes, you can. Several crypto wallets offer users an opportunity to stake Tether holdings. Plus, it is easy to get started. You can stake your USDT on Bit2Me Earn, Atomic Wallet, and Kraken.

Where Can I Convert USDT to Cash?

You can convert USDT to cash on Breet. The crypto-to-cash platform offers a swift and convenient conversion experience. Plus, you get competitive rates ensuring the best value on each transaction. Visit Breet now to get started.

What Are the Best Trading Strategies?

The best trading strategy depends solely on your risk appetite and preference. These strategies include Dollar Cost Averaging, Scaling, and Arbitrage.

Dollar Cost Averaging is when you split your capital into small bits to invest following a schedule. Scalping is betting on little changes in a trend to make profits. Finally, Arbitrage is utilizing the price difference between an asset on two different exchanges to make a profit. You can try any option and see how it turns out.

Is Buying Tether (USDT) A Good Crypto Investment?

Tether is a stable investment that offers many use cases. You also have opportunities for active and passive income. If you have a low-risk appetite, Tether is a pretty solid crypto investment to start with.

Conclusion

Tether (USDT) is stable and offers countless opportunities to upscale your portfolio. If you want to start trading USDT, this guide covers indispensable strategies you should note to get the most out of your holdings. When it is time to reap your profits, choosing Breet is a step in the right direction. The platform allows you to convert your USDT to Naira or Cedis in a couple of minutes. Also, you get top-tier security and competitive rates.

Stay safe and trade responsibly.